Field-Programmable Gate Array Market to Expand to USD 39 Bn by 2033, 46.5% SRAM-based Technology Share

Field-Programmable Gate Array (FPGA) Market Size

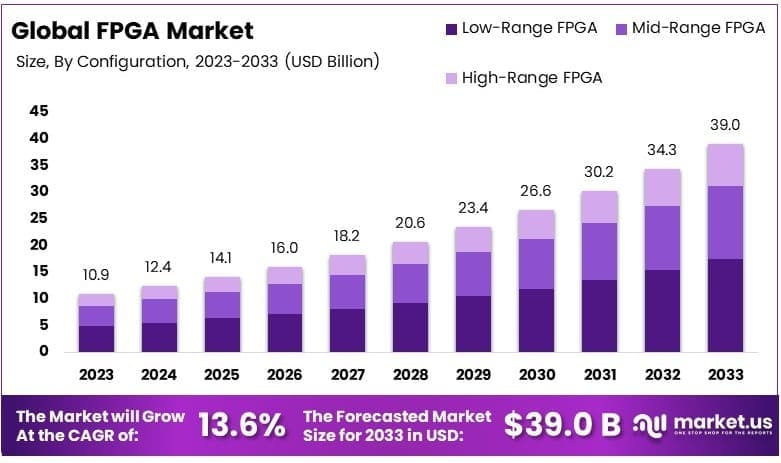

The Field-Programmable Gate Array (FPGA) Market is anticipated to grow from USD 12.4 bn in 2024 to USD 39.0 bn by 2033, registering a robust 13.6% CAGR.

NEW YORK, NY, UNITED STATES, January 24, 2025 /EINPresswire.com/ -- According to the research conducted by Market.us, The Global Field-Programmable Gate Array (FPGA) market refers to the industry focused on programmable semiconductor devices that allow users to customize hardware configurations after manufacturing. These versatile chips are widely used across industries, including telecommunications, automotive, healthcare, and aerospace, due to their reconfigurability, high processing speeds, and adaptability to evolving technology demands.

The growth of the FPGA market is driven by increasing demand for high-performance computing, growing adoption of IoT devices, and the rapid deployment of 5G networks. FPGAs provide the flexibility and low-latency performance required for real-time data processing in telecommunications and data centers. Additionally, the automotive sector’s shift toward autonomous vehicles and advanced driver-assistance systems (ADAS) has amplified the demand for FPGAs due to their ability to process complex algorithms for sensor fusion and machine learning.

The rise of artificial intelligence (AI) is significantly shaping FPGA market trends. AI applications, particularly in deep learning, benefit from FPGAs’ parallel processing capabilities, enabling faster training and inference of machine learning models. Major tech companies are increasingly integrating FPGAs into AI accelerators for applications like natural language processing, computer vision, and real-time analytics.

👉 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=101321

Technological advancements, such as the integration of system-on-chip (SoC) FPGAs and the development of power-efficient devices, are expanding market opportunities. The increasing use of FPGAs in edge computing and real-time analytics solutions further drives demand. Furthermore, innovations in smaller node manufacturing processes, such as 7nm and below, have enhanced FPGA performance, reducing power consumption and enabling their use in compact, high-demand applications like wearable devices and drones.

Key Takeaways

In 2023, Low-Range FPGA dominated the configuration segment with 44.8% due to its cost-effectiveness and widespread adoption in various applications.

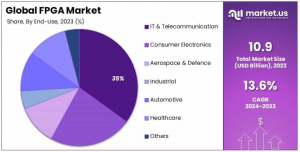

In 2023, IT & Telecommunication was the leading end-use segment with 35%, driven by increasing demand for high-performance computing and data processing.

In 2023, SRAM-based technology led the market with 46.5%, attributed to its reprogrammability and flexibility in diverse applications.

In 2023, IT & Telecommunication was the leading end-use segment with 35%, driven by increasing demand for high-performance computing and data processing.

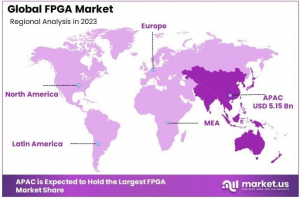

In 2023, Asia Pacific dominated the market with 47.3% market share, reflecting the region’s strong semiconductor manufacturing base and growing electronics industry.

Analyst Viewpoint

The Global FPGA Market is poised for substantial growth, driven by the rising adoption of FPGAs across industries such as telecommunications, automotive, data centers, and healthcare. This growth is fueled by increasing demand for high-performance, reconfigurable hardware to support advancements in 5G networks, AI/ML applications, and autonomous vehicles.

Investment opportunities in the FPGA market are abundant, particularly in sectors like edge computing, industrial automation, and AI acceleration. The integration of FPGAs into AI systems, including real-time analytics and deep learning applications, presents a lucrative avenue for growth. Additionally, the rising trend of smart cities and IoT adoption in emerging economies like India, Brazil, and Southeast Asia is driving demand for compact and power-efficient FPGAs.

Government incentives and funding for semiconductor manufacturing, especially in regions like the United States (CHIPS Act) and European Union’s semiconductor initiatives, are bolstering market development. These policies aim to enhance domestic production capabilities and reduce supply chain vulnerabilities, offering a favorable environment for FPGA innovation. However, analysts caution that geopolitical tensions and rising raw material costs pose risks to market stability.

Technological innovations, such as system-on-chip (SoC) FPGAs, advancements in 7nm and below manufacturing processes, and AI-enabled design tools, are significantly enhancing FPGA performance while reducing power consumption and size. However, challenges persist in the form of high development costs, consumer awareness gaps, and stringent regulatory environments, particularly in industries like healthcare and defense, where compliance is critical.

👉 𝐂𝐥𝐢𝐜𝐤 𝐭𝐨 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞 𝐈𝐦𝐩𝐚𝐜𝐭𝐟𝐮𝐥 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬: https://market.us/report/fpga-market/request-sample/

Report Segmentation

Configuration Analysis

In 2023, Low-Range FPGA dominated the configuration segment with 44.8% due to its cost-effectiveness and widespread adoption in various applications. This dominance is attributed to the cost-effectiveness and versatility of low-range FPGAs, making them a preferred choice for various applications in industries such as consumer electronics, automotive, and industrial automation. Their energy efficiency and ability to handle essential processing tasks at lower costs have made them particularly attractive for small- and medium-scale enterprises seeking affordable programmable solutions.

The Mid-Range FPGA segment is witnessing steady growth due to its balance between performance and cost. These FPGAs are widely used in communication infrastructure, automotive systems, and medical devices, where moderate computational power is required without compromising efficiency. The growing adoption of 5G networks and IoT devices is expected to fuel demand for mid-range FPGAs in the coming years.

The High-Range FPGA segment, while capturing a smaller share, is expanding rapidly due to its applications in data centers, aerospace, and defense industries. High-range FPGAs are known for their superior performance, scalability, and ability to handle complex computations, making them ideal for high-performance computing tasks, AI workloads, and advanced signal processing. Although their higher costs limit their use to specialized industries, the increasing adoption of AI and machine learning applications is driving demand for this segment.

Technology Analysis

In 2023, SRAM-based technology led the market with 46.5%, attributed to its reprogrammability and flexibility in diverse applications. The dominance of SRAM-based FPGAs is attributed to their reprogrammability and flexibility, making them ideal for dynamic applications across diverse industries such as telecommunications, automotive, and data centers. Their ability to support high-speed operations and complex algorithms, coupled with scalability, positions SRAM-based FPGAs as the preferred choice for high-performance computing tasks and artificial intelligence workloads. Additionally, advancements in SRAM-based architectures are driving innovations in 5G network deployment and edge computing, further solidifying their market leadership.

The Flash-based technology segment is gaining momentum due to its inherent advantages such as non-volatility, lower power consumption, and high resistance to radiation, making it particularly suitable for aerospace, defense, and industrial automation applications. The demand for Flash-based FPGAs is expected to grow as industries prioritize energy-efficient and reliable solutions for mission-critical systems.

The Antifuse-based technology segment, while smaller in market share, continues to find niche applications where high-security and tamper-resistance are crucial. These FPGAs are primarily used in military and aerospace sectors where reliability and permanent configurations are required.

End Use Analysis

In 2023, the IT & Telecommunication segment was the leading end-use segment in the global FPGA market, accounting for 35% of the market share. This dominance is driven by the increasing demand for high-performance computing and data processing in telecommunications networks. With the rapid deployment of 5G technology, FPGAs are being widely adopted for their ability to handle complex signal processing and adapt to evolving communication standards. Additionally, the growing data traffic in cloud computing and the expansion of data centers have further fueled the demand for FPGAs in this segment.

The Consumer Electronics segment is also experiencing significant growth, as FPGAs are increasingly used in devices such as smartphones, gaming consoles, and wearable technology. Their versatility and ability to support advanced features like AI and real-time processing make them ideal for next-generation consumer devices.

👉 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭@ https://market.us/report/fpga-market/free-sample/

Regional Analysis

In 2023, Asia Pacific dominated the FPGA (Field Programmable Gate Array) market with a 47.3% market share, reflecting the region’s strong semiconductor manufacturing base and rapidly growing electronics industry. Countries like China, Taiwan, South Korea, and Japan are at the forefront of FPGA adoption, driven by their leadership in the production of consumer electronics, automotive electronics, and advanced telecommunications infrastructure.

The expanding demand for 5G networks, coupled with rising investments in AI and IoT applications, has further bolstered the FPGA market in the region. Additionally, government initiatives supporting semiconductor innovation and local production in countries like China and India are expected to accelerate market growth.

North America held a significant share in the FPGA market, owing to its leadership in aerospace, defense, and high-performance computing industries. The presence of key FPGA manufacturers, coupled with advancements in technologies such as AI accelerators and data center applications, is driving adoption in the region. The increasing focus on autonomous vehicles and edge computing also positions North America as a key player in the FPGA landscape, supported by significant R&D investments and government-funded projects.

Key Player Analysis

One of the leading player in the market is Lattice Semiconductor Corp. a provider of low-power, small-form-factor FPGA solutions designed for a wide range of applications. The company's FPGAs are recognized for their power efficiency and are tailored for edge computing, industrial automation, automotive systems, and consumer electronics.

Another prominent player is Achronix Semiconductor Corp. that specializes in solutions for data-intensive applications in AI/ML, networking, and data centers. Their FPGAs stand out due to their speed, bandwidth capabilities, and advanced architecture.

Top Key Players in the Market

• Intel Corporation

• Advanced Micro Devices, Inc. (Xilinx, Inc.)

• Microchip Technology Inc.

• Lattice Semiconductor Corp.

• Achronix Semiconductor Corp.

• ADICSYS

• Efinix, Inc.

• QuickLogic Corporation

• Renesas Electronics Corp.

• Flex Logix Technologies, Inc.

• Other Key Players

Emerging Trends

FPGAs are becoming central to AI and machine learning applications due to their parallel processing capabilities, high flexibility, and low latency. These devices are widely used in AI accelerators for real-time data processing in applications such as natural language processing, image recognition, and autonomous systems. The ability to customize hardware for specific AI workloads makes FPGAs an essential tool for achieving performance efficiency in edge and cloud-based AI deployments.

The shift toward edge computing to reduce data transmission costs and enable real-time decision-making is driving demand for FPGAs. With their ability to process data locally and reconfigure hardware for different tasks, FPGAs are becoming the preferred choice for IoT devices, industrial automation, and smart city solutions that require low-latency processing and energy efficiency.

Top Use Cases

Telecommunications and 5G Infrastructure: FPGAs play a critical role in the deployment of 5G networks, particularly in base stations, signal processing, and network functions virtualization (NFV). They enable real-time processing, low latency, and high bandwidth capabilities essential for 5G communication. FPGAs also support evolving communication standards, making them indispensable for future-proofing telecom infrastructure.

Data Centers and Cloud Computing: FPGAs are increasingly used in data centers to accelerate workloads such as AI inference, database search, and high-frequency trading. Companies like Microsoft and Amazon integrate FPGAs to optimize performance and energy efficiency in cloud computing services. Their ability to handle parallel processing makes them ideal for high-speed data analytics and real-time operations.

Automotive and Autonomous Vehicles: The automotive industry leverages FPGAs for advanced driver-assistance systems (ADAS), sensor fusion, and autonomous driving. Their reprogrammable nature allows real-time updates and adjustments to algorithms, essential for safety-critical applications. FPGAs also support LiDAR, radar, and vision-based systems, crucial for self-driving vehicles.

Major Challenges

One of the major challenges in the FPGA market is the high cost associated with designing and deploying FPGA-based solutions. The devices themselves are often expensive compared to other hardware solutions like ASICs (Application-Specific Integrated Circuits) for large-scale production. Additionally, the development process involves significant investment in specialized design tools, expertise, and time. For smaller companies, these costs can create barriers to adoption and limit market penetration.

FPGAs require specialized skills in hardware description languages (HDLs) such as VHDL or Verilog, making their programming a challenging task. Developers need to have in-depth knowledge of digital design, which increases the demand for skilled professionals. Furthermore, integrating FPGAs into existing systems often requires extensive customization, adding to the overall complexity of implementation.

Attractive Opportunities

The global rollout of 5G networks presents a significant opportunity for FPGAs, as they play a critical role in enabling high-speed, low-latency communication. FPGAs are being extensively utilized in base stations, network infrastructure, and wireless communication systems due to their ability to handle complex signal processing tasks, adapt to changing standards, and scale with growing network demands.

FPGAs are increasingly being adopted as accelerators in AI and ML applications. Their parallel processing capabilities and adaptability make them ideal for deep learning workloads, including real-time analytics, image recognition, and natural language processing. This demand is particularly strong in data centers and edge computing, where flexibility and efficiency are key.

The automotive industry’s transition toward autonomous vehicles and advanced driver-assistance systems (ADAS) is creating significant demand for FPGAs. These chips are crucial for processing sensor data, enabling real-time decision-making, and supporting machine learning algorithms in safety-critical applications like collision avoidance and lane detection.

👉 𝐆𝐞𝐭 𝐏𝐃𝐅 𝐅𝐨𝐫 𝐌𝐨𝐫𝐞 𝐏𝐫𝐨𝐟𝐞𝐬𝐬𝐢𝐨𝐧𝐚𝐥 𝐀𝐧𝐝 𝐓𝐞𝐜𝐡𝐧𝐢𝐜𝐚𝐥 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬@ https://market.us/report/fpga-market/request-sample/

Recent Developments

In January 2025, Altera Corporation, a leader in FPGA innovations, announced the launch of its Altera Solution Acceleration Partner (ASAP) Program, an initiative designed to help companies accelerate innovation, get to market faster and grow their businesses more efficiently with support from Altera and its partner ecosystem. The ASAP program delivers the resources and support to ensure companies have the necessary tools to solve their complex design challenges and compete in today’s rapidly evolving market being driven by artificial intelligence.

In November 2024, AMD releases Alveo UL3422, an ultra-low latency accelerator card in a slim form factor, delivering record trade speeds for high-frequency trading tasks.

In March 2024, Intel announced the official launch of Altera, its n new standalone field programmable gate array (FPGA) company. Altera is positioned to capitalise on a total addressable market opportunity of over $55 billion across cloud network, edge computing, and other segments.

Conclusion

The Global FPGA market is poised for significant growth, driven by increasing demand for high-performance, customizable solutions across industries such as telecommunications, automotive, healthcare, and defense. Advancements in AI, 5G, and edge computing, along with innovations in low-power and compact FPGA designs, present lucrative opportunities for market expansion. As industries continue to prioritize real-time processing, adaptability, and energy efficiency, FPGAs are set to play a pivotal role in shaping the future of technology, making this market a key area of interest for investors and stakeholder.

𝐄𝐱𝐭𝐞𝐧𝐬𝐢𝐯𝐞 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐢𝐧 𝐭𝐡𝐞 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲 𝐃𝐨𝐦𝐚𝐢𝐧:

Marketing Automation Market - https://market.us/report/marketing-automation-market/

Generative AI in Marketing Market - https://market.us/report/generative-ai-in-marketing-market/

Video Conferencing Market - https://market.us/report/video-conferencing-systems-market/

Debt Financing Market - https://market.us/report/debt-financing-market/

AI in Predictive Maintenance Market - https://market.us/report/ai-in-predictive-maintenance-market/

Computer Aided Engineering Market - https://market.us/report/computer-aided-engineering-market/

Smart Lighting Market - https://market.us/report/smart-lighting-market/

Extended Reality Market - https://market.us/report/extended-reality-market/

Visual Effects (VFX) Market - https://market.us/report/visual-effects-vfx-market/

Printed Electronics Market - https://market.us/report/printed-electronics-market/

Hardware in The Loop (HIL) Market - https://market.us/report/hardware-in-the-loop-hil-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Electronics Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release