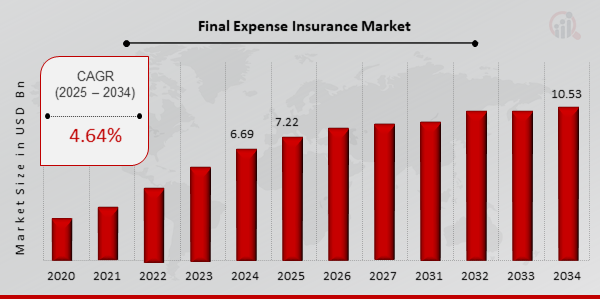

Final Expense Insurance Market Anticipated to Attain 10.53 billion By 2034, at 4.64% CAGR

Final Expense Insurance Market Growth

Final Expense Insurance Market Research Report By, Policy Type, Coverage Amount, Target Audience, Distribution Channel, Premium Payment Frequency, Regional

SD, UNITED STATES, March 12, 2025 /EINPresswire.com/ -- The Final Expense Insurance Market has experienced steady growth in recent years and is expected to expand further over the coming decade. In 2024, the market size was estimated at USD 6.69 billion, and it is projected to grow from USD 7.22 billion in 2025 to USD 10.53 billion by 2034, reflecting a compound annual growth rate (CAGR) of 4.64% during the forecast period (2025–2034). The market's expansion is primarily driven by the increasing demand for affordable end-of-life coverage, rising awareness of financial planning, and the growing aging population.

Key Drivers of Market Growth

1. Increasing Demand for Affordable Burial & Funeral Coverage

Final expense insurance provides a cost-effective solution for individuals seeking to cover funeral expenses, medical bills, and other end-of-life costs, driving market demand.

2. Growing Aging Population

With a rising elderly population worldwide, the demand for final expense insurance policies is increasing as individuals seek financial security for their families.

3. Expansion of Digital Insurance Solutions

The adoption of digital platforms for policy purchases, claims processing, and customer support is enhancing accessibility and convenience for consumers.

4. Rising Awareness of Financial Planning

Consumers are becoming more conscious of the financial burdens associated with end-of-life expenses, leading to increased adoption of final expense insurance.

5. Simplified Underwriting & No Medical Exam Policies

Many insurers offer simplified underwriting processes, including no medical exams, making it easier for individuals to obtain coverage, particularly those with pre-existing conditions.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/23889

Key Companies in the Final Expense Insurance Market Include:

• Hartford

• Bankers Life

• Americo

• Gerber Life

• Globe Life

• Modern Woodmen

• Transamerica

• United Home Life

• Old American

• Mutual of Omaha

• Assurity

• Woodmen Life

• Principal Financial Group

• Lincoln Heritage

• Foresters Financial

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/final-expense-insurance-market-23889

Market Segmentation

To provide a comprehensive analysis, the Final Expense Insurance Market is segmented based on policy type, distribution channel, end-user, and region.

1. By Policy Type

• Guaranteed Issue Life Insurance: No medical exams required, coverage for high-risk individuals.

• Simplified Issue Life Insurance: Minimal underwriting, quick approval process.

• Pre-Need Funeral Insurance: Directly linked to funeral service providers.

2. By Distribution Channel

• Agents & Brokers: Traditional sales channels providing personalized guidance.

• Direct-to-Consumer: Online platforms and telemarketing sales.

• Banks & Financial Institutions: Bancassurance partnerships offering insurance products.

3. By End-User

• Senior Citizens: Primary target group seeking financial security.

• Low & Middle-Income Groups: Consumers looking for affordable insurance solutions.

• Individuals with Pre-Existing Conditions: Beneficiaries of no medical exam policies.

4. By Region

• North America: Leading market with high awareness and established insurance providers.

• Europe: Growing adoption due to increasing elderly population.

• Asia-Pacific: Emerging market with rising financial literacy and insurance penetration.

• Rest of the World (RoW): Gradual market expansion with increasing insurance accessibility.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23889

The global Final Expense Insurance Market is set for steady growth, driven by the increasing demand for end-of-life financial protection, simplified policy options, and digital advancements in the insurance sector. As consumers prioritize financial planning, the market will continue evolving with innovative products and expanded accessibility, ensuring comprehensive coverage for policyholders.

Related Report –

Commercial Payment Cards Market

https://www.marketresearchfuture.com//reports/commercial-payment-cards-market-23869

Generative Ai In Insurance Market

https://www.marketresearchfuture.com/reports/generative-ai-in-insurance-market-31676

Starter Credit Card Market

https://www.marketresearchfuture.com/reports/starter-credit-card-market-28139

Usage Based Car Insurance Market

https://www.marketresearchfuture.com/reports/usage-based-car-insurance-market-28395

Retail Banking Market

https://www.marketresearchfuture.com/reports/retail-banking-market-32246

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release