No Credit Check Loans - Credit Clock is the Number 1 Pick for US Customers

Credit Clock emerges as the top-rated platform for US borrowers seeking no credit check loans in 2025, offering flexible repayment terms, fast approvals, and transparent loan options for those with bad or no credit.

/EIN News/ -- Memphis, May 19, 2025 (GLOBE NEWSWIRE) --

Do you have a hard time making both ends meet and require immediate cash? In most cases, having a poor credit score can make it tough to locate a lender that is willing to give you a no credit check loan.

However, there's no need to worry—we have good news for you. Our team has extensively researched the American market and identified the most exceptional lenders that offer no credit check loans.

These loans help you cover unexpected expenses and financial shortfalls. As such, they serve as reliable financial aid for emergencies and assist between pay periods. Read on to get more insight on them.

Top US No Credit Check Loan Lenders

- Credit Clock: Longer loan repayment periods

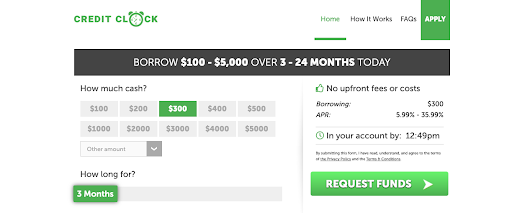

Credit Clock is a top selection for borrowers with bad credit and no credit history looking to obtain no credit check loans in the US in 2025. The company is best known for its longer repayment periods, which give the borrower ample time to repay the loan. The loan amounts start from $100 to $5,000. This amount range ensures that you meet your financial needs. On top of that, no extra charges or costs are added to the loan.

Below are some of the benefits of using Credit Clock as your preferred lender:

- Flexible repayment periods of up to 24 months.

- Fast approval processes.

- Flexible lending amounts.

- Reputable lenders.

- Soft credit checks.

- No hidden charges or costs.

Credit Clock ensures that you get your loans in time through same-day approvals, helping your financials meet your needs.

What Is a No Credit Check Loan?

A no credit check loan is a type of loan that does not require the lender to perform credit checks on the borrower. As such, credit history and credit score are not important factors to consider when approving such loans. This fact makes no credit check loans a suitable borrowing option for individuals who have poor credit scores or bad credit histories and have no chance of being granted loans by financial institutions.

These loans do not require any security as collateral and are usually accompanied by interest rates that are relatively higher than those offered by conventional financial institutions. Therefore, it is highly advised that you thoroughly examine the fees, rates, and terms before taking them.

What Are the Examples of No Credit Check Loans

Several types of loans can be extended to borrowers without having hard credit checks performed. They include:

- Payday loans – These are short-term loans that are taken to be repaid on the borrower’s next payday. They are taken in small amounts that could range from a few hundred dollars to a few thousand dollars and are meant to cover unexpected expenses before payday.

- Car title loans – These are secured loans that use the vehicle as collateral. The lenders of car title loans tend to hold onto the title of the vehicle until the loan is paid back in full. It is key to note that they have high-interest rates and fees.

- Cash advance – A cash advance is a type of short-term loan that allows you to borrow money against your future paycheck. Cash advances can be obtained through your credit card or a payday lender.

- No credit check installment loans – An installment loan is a type of loan that is repaid over time through a series of scheduled payments or, better yet, installments. They can be used for various purposes, such as home repairs, medical bills, or car purchases, and are available through a variety of lenders.

- Personal lines of credit – A personal line of credit is a flexible borrowing option that allows you to access funds as needed, up to a predetermined credit limit. These are similar to credit cards, but instead of a revolving credit limit, you are given a line of credit that you can draw from as needed.

What to Look at to Get the Best No Credit Check Loan

When obtaining a no credit check loan, there are important aspects that must be considered to ensure you not only get the best lenders and offers but also make an informed decision. Some of those factors include:

- Interest rates – The interest rate, being the amount that the lender charges on the loan has to be compared between various lenders to ensure that you get the lowest rates available.

- Fees – It is important to read carefully the terms of the loans and understand all the fees associated with the loan before agreeing to it. These fees may include origination fees and late repayment fees among others.

- Online reviews – It is of the essence to take a sneak peek at the online reviews of the possible lenders to have a glimpse of what previous borrowers have to say. This will give you an idea of the lender's reputation and customer service.

- Licensing – Laws regarding no credit check loans are not similar in all states. As such, it is important to ensure that the lender you choose is licensed to operate in your state and is compliant with all state laws. Licensed lenders tend to follow the regulations on fee limits, interest rates, and loan terms.

- Terms – Understand the loan terms and conditions, such as the repayment period, payment frequency, and any penalties for early or late repayment. Ensure that the terms are favorable and suit your financial needs.

Alternatives to No Credit Check Loans

When you need quick cash, you may consider getting a no credit check loan. However, it is important to note that there are several alternatives to no credit check loans. Here are some options, especially if you have a good credit score:

- Personal loans – If you have a good credit score, you may be able to qualify for a personal loan from a bank, credit union, or online lender. Personal loans typically have lower interest rates than no credit check loans and may have more flexible repayment terms.

- Co-signer loans - Getting a co-signer with good credit to apply for a loan gives you a higher chance of approval and getting a favorable interest rate. However, it is important to repay the loan on time to improve your credit and avoid leaving the co-signer responsible for the payments.

- Credit unions – Unlike banks, credit unions offer loans at lower interest rates than most traditional lenders. They often provide flexible repayment terms and lower fees.

- Secured loans – Secured loans require collateral, such as a car or property, to secure the loan. They have lower interest rates than unsecured loans as the collateral reduces the risks associated.

- Bad credit loan lenders – These are lenders who are specifically designed for borrowers with poor credit scores. These lenders offer loans with higher interest rates and fees, but they are more willing to lend a helping hand if you have a low credit score.

Eligibility Criteria for No Credit Check Loans

Even though no credit checks are performed for no credit check loans, there are several other background checks that lenders perform to ensure eligibility. They are:

- A US citizenship.

- Be at least 18 years of age.

- A verifiable source of income.

- An active bank account.

- Functional contact details.

The above qualifications are easily met by a fair share of applicants and as a result, high approval rates are attributed to no credit check loans.

In addition, the application processes are easy to follow, and the cash payouts are almost instantaneous, as they are instantly approved.

Frequently Asked Questions

Do I have to visit a physical store to apply for a no credit check loan?

No, most lenders offering no credit check loans have online applications. You can apply for the loan online and receive the funds directly deposited to your bank account.

How much can I borrow?

The amount you can borrow depends on the lender's policies. The maximum amount you can get from a no credit check loan is $50,000.

Do I have to pay fees?

Not necessarily. Most lenders do not charge prior or extra fees for loans. Nonetheless, some charge application fees, processing fees, and late payment fees. The fees vary by lender, and you should review the terms and conditions carefully before accepting a loan offer.

Are no credit check loans a good idea?

No credit check loans are a good option for people with bad credit or no credit history who need quick cash. However, it is vital to ensure that you can adhere to the loan's terms and policies.

What happens if I miss a loan repayment?

If you miss a loan repayment for a no credit check loan, you will likely face additional fees and interest charges. In addition, your credit score may be negatively impacted, making it harder for you to obtain credit in the future. Some lenders may also report late payments to credit bureaus, which can lower your credit score. It's important to contact your lender as soon as possible if you think you may miss a payment and work out a plan to avoid any negative consequences.

Company Name:Payday Ventures Ltd (trading as Credit Clock)

Email:business@paydayventures.com

Phone:+44 208 064 1293

Disclaimer & Affiliate Disclosure

The information presented in this press release is provided for general informational purposes only and does not constitute financial advice, lending advice, or legal guidance. Credit Clock is not a lender, does not make credit decisions, and does not issue any loan or financial product directly. All loans are subject to the approval criteria and underwriting processes of independent third-party lenders or lending networks, which may include additional checks and verification of eligibility.

Loans facilitated through the Credit Clock platform are available to individuals aged 18 and over, contingent upon status, state of residence, and the criteria set by lending partners. Availability of products and services may vary by jurisdiction and may not be accessible to residents of all U.S. states. Services are explicitly unavailable in the following states: Arkansas, Connecticut, New Hampshire, New York, Montana, South Dakota, Vermont, West Virginia, Indiana, and Minnesota.

This press release may contain references to third-party offers, services, or products. Any representations, benefits, rates, or terms mentioned are subject to change at the sole discretion of the respective provider. No guarantees are made regarding loan approval, loan amounts, or funding timelines. While some lenders may offer loans up to $5,000, this amount is not guaranteed and will depend on individual qualifications and lender policies. Some lenders may conduct soft or hard credit checks with credit bureaus such as Experian, Equifax, or TransUnion, or use alternative credit reporting systems.

No Guarantee of Loan Approval or Terms

Completing the online form does not constitute a loan application and does not guarantee approval, qualification, or receipt of funds. Credit Clock uses a proprietary algorithm to connect users with potential lenders based on the borrower’s profile and the available lending options within its network. Not all lenders or loan products are accessible through this service, and users are encouraged to independently evaluate all available financial solutions to determine what best suits their individual needs.

Funding Model and Compensation Disclosure

This website does not charge users any fees for submitting loan requests. The operator of this website is a broker, not a direct lender. Compensation is received from lenders, lender networks, and other marketers in the network when a user is matched and offered a financial product or alternative lending option through this platform.

Annual Percentage Rates (APR) and Terms

Representative APRs for installment loans accessed through this service may range from 5.99% to 35.99%. The minimum repayment term is 61 days. Actual APRs and loan terms may vary depending on the borrower’s creditworthiness, financial history, state of residence, and lender assessment. APR disclosures are based on historical lender data and are illustrative only; they do not reflect a guarantee of rates. Not all users will qualify for the lowest advertised rates.

Tribal Lender Disclosures

Some lending partners may operate under tribal jurisdiction and are governed by federal and tribal laws, not state law. As such, rates, fees, and loan terms may differ substantially from those offered by state-licensed lenders and may be higher in certain cases. Consumers should review all loan agreements thoroughly before accepting terms.

Publisher & Syndication Partner Disclaimer

The content herein is distributed for informational purposes only and reflects the opinions of the original source at the time of publication. All facts, figures, representations, and claims regarding loan services or benefits are provided by Credit Clock and are subject to change without notice. Neither the publisher of this press release nor any affiliated distribution or syndication network shall be held liable for errors, inaccuracies, outdated information, or omissions contained herein. This release may contain typographical errors or inadvertent misstatements.

Parties interested in financial products described herein are strongly advised to conduct independent due diligence, verify terms directly with lenders, and seek appropriate legal or financial counsel prior to entering any agreement.

Company Name: Payday Ventures Ltd (trading as Credit Clock)

Address: 86-90 Paul Street

City: London

State/Province: Greater London

ZIP/Postal Code: EC2A 4NE

Country: United Kingdom

Website: https://www.creditclock.net

Email: business@paydayventures.com

Phone: +44 208 064 1293

Distribution channels: Banking, Finance & Investment Industry, Media, Advertising & PR ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release