Personal Loans for Bad Credit - Credit Clock Rated Best In US 2025

Struggling with Poor Credit? Credit Clock Emerges as 2025’s Top-Rated Personal Loan Platform Offering Fast Approvals, Flexible Repayments, and No Credit Checks

/EIN News/ -- Atlanta, May 19, 2025 (GLOBE NEWSWIRE) --

If you are looking for a personal loan but having problems because of bad credit, we have you covered. We have found the best personal loan lender just for you. Our top lender has a flexible repayment period; check out Credit Clock below to learn why it's our number one lender.

With the prices of goods in the U.S. soaring while wages remain constant, many people are left at the mercy of loans due to their limited income levels. However, accessing a loan in such tough economic times can also be hectic, especially with a bad credit score.

To help alleviate this problem, our team has scoured the personal finance market and identified a list of brokers from whom you can quickly get personal loans for bad credit without having to undergo any credit checks. This is made possible by a network of lenders that focus more on the borrower’s ability to repay the loan than credit ratings.

Top Personal Loans for Bad Credit

With these brokers, securing a personal loan for bad credit from these lenders is straightforward. Just click on the provided links and follow the simple application process.

If you seek further information to make an informed choice among lenders, continue reading for an in-depth review of each option.

- Credit Clock: Reliable personal loans for bad credit

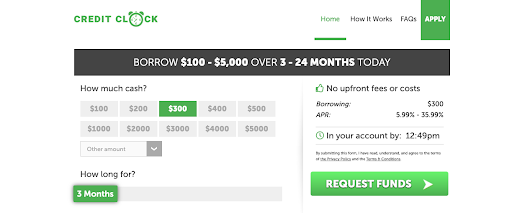

Credit Clock is a unique personal loan for bad credit lenders that stands out from the rest by offering its services for 24 hours. It doesn’t have conventional and strict working hours that limit when you can apply for a personal loan for bad credit. As such, you can apply for a loan when you need it.

With such flexible services, Credit Clock manages to keep its loans for bad credit low by having low interest rates and eliminating upfront costs and hidden charges that may add to the cost of the loan.

Credit Clock’s online platform allows you to access personal loans for bad credit of up to $5,000. Tagging along with this lending range are the following benefits of utilizing Credit Clock’s platform:

- Fast loan approvals.

- Flexible loan amounts.

- Negotiable and flexible repayment terms.

- It has a quick and convenient application process.

- Quick loan payouts.

Credit Clock is a reliable personal loan for bad credit lenders with reputable lenders who see that you get the financial assistance you need when you need it most.

What Is a Personal Loan for Bad Credit?

A personal loan for bad credit is an unsecured financial lifeline designed for individuals with a less-than-favorable credit history, mostly characterized by a low credit score due to past financial challenges, missed payments, or defaults. For that reason, personal loans for bad credit are only offered by specialized lenders willing to work with borrowers despite their poor credit scores and ratings.

Compared to conventional loans, personal loans for bad credit come with relatively higher interest rates. This is because lenders charge a higher rate to compensate for the increased risk associated with borrowers with subprime credit scores.

Something else to note about personal loans for bad credit is that the loan amounts available are smaller, the repayment periods are shorter, and monthly payments are potentially higher than normal conventional loans.

Eligibility Criteria for Personal Loans for Bad Credit

Personal loans for bad credit, like other conventional loans, have requirements that should be met before approval, even though they differ. Below are the factors that are considered for eligibility for personal loans for bad credit:

- Citizenship or permanent residency – You must be a U.S. citizen or a permanent resident.

- Age requirement – The minimum age for a personal loan to be approved is 18.

- Verifiable income – You ought to have a verifiable and reliable source of income, be it from employment, self-employment, government benefits, or any other sources.

- Debt-to-income ratio (DTI) – To qualify, you should have a favorable debt-to-income ratio.

- Active bank account – You must have an active bank account, which will be used for loan disbursement and automatic repayments.

- Contact Information – You must provide a valid phone number and/or an active email address for communication between you and the lender.

Meeting these eligibility requirements increases your chances of approval when applying for personal loans for bad credit. As they are easy to meet, the approval rates for online personal loans for bad credit are often relatively high.

Who Can Benefit from Personal Loans for Bad Credit?

Throughout their existence, personal loans for bad credit have gained popularity because they cater to a diverse range of individuals, including:

- Individuals with low credit scores – People with low credit scores often turn to personal loans for bad credit because they have difficulties qualifying for prime loans offered by traditional lenders as they are rendered high-risk borrowers, making many lenders hesitant to approve their requests.

- Individuals with limited credit history – As borrowers with limited credit history often struggle to access traditional loans, personal loans for bad credit offer them an opportunity to establish credit and access financing, even with their limited credit profiles.

- Borrowers with past financial difficulties – Individuals who have experienced financial setbacks like bankruptcy or foreclosure find it challenging to qualify for conventional loans. For this reason, they turn to personal loans for bad credit as they are more accessible.

- Self-employed workers – Self-employed borrowers often contend with inconsistent income flows, and consequently, they may need to borrow funds during periods of insufficient income to cover expenses. As it may be a tough feat for them to meet the requirements of conventional loans, personal loans for bad credit offer access to financing when needed.

- Low-income borrowers – Borrowers with low incomes frequently turn to personal loans for bad credit because they struggle to meet the debt-to-income ratio requirements associated with conventional loans. Thus, relying on personal loans for various purposes provides a more accessible financing option.

Tips for Managing Personal Loans for Bad Credit

When appropriately managed, personal loans for bad credit can be a powerful tool that helps you attain financial freedom and stability. Below are tips on how to manage personal loans for bad credit:

- Create a budget – By developing a comprehensive budget that outlines your income and expenses, you get a clear picture of your financial situation and enable you to allocate funds effectively.

- Make timely payments – Ensure you make your repayments on time to avoid late fees and penalties, which have the potential to impact your credit score negatively. You can consider setting up automatic payments or creating reminders to stay on top of due dates.

- Cut expenses and increase income – Identifying areas where you can cut expenses and redirect those savings toward debt repayment and exploring ways to increase your income will accelerate your progress in paying off personal loans for bad credit.

- Seek professional advice - You can seek guidance from a credit counseling agency or a financial advisor who will provide personalized strategies to help you navigate your specific debt challenges and create a manageable repayment plan.

- Practice self-discipline and patience –By being patient and disciplined, you will be better positioned to stay committed to your debt repayment plan, which requires consistent effort and perseverance.

By following these tips and adopting responsible financial habits, you can better manage your loans for bad credit, improve your overall financial health, and work toward achieving your financial goals.

How Can I Effectively Use a Personal Loans for Bad Credit?

Personal loans for bad credit offer financial assistance to individuals despite their credit challenges. Below, we will delve into some of the most common and practical ways people utilize these loans.

- Debt consolidation – Personal loans for bad credit can combine high-interest debts and multiple loans into a single personal loan, which helps you manage your debt more effectively.

- Emergency expenses – Personal loans for bad credit provide a financial safety net for unexpected and urgent expenses when you don't have readily available funds.

- Credit score improvement – Personal loans for bad credit can be used as a strategic tool to start rebuilding your credit history. This is done by borrowing responsibly and making timely payments, which will demonstrate improved financial responsibility, potentially opening up access to better loan terms.

- Small business ventures - If you are an aspiring entrepreneur or a small business owner with bad credit, you can turn to a personal loan with bad credit to kickstart or expand your business.

Alternatives to Bad Credit for Personal Loans

- Secured loans – As secured loans require collateral, they often offer lower interest rates compared to unsecured personal loans, such as personal loans for bad credit.

- Credit unions – By being a credit union member, you become eligible for loans with favorable loan terms as they have relatively lower interest rates. Additionally, credit unions may be willing to work with members with less-than-perfect credit, making them a good alternative.

- Peer-to-peer (P2P) lending – P2P lending platforms connect borrowers with individual investors who fund loans and usually have less stringent credit requirements and lower interest rates than other lending institutions.

- Credit counseling – Nonprofit credit counseling agencies are a go-to alternative as they provide financial advice and assistance to individuals struggling with debt. They can also help create budgets, negotiate with creditors for lower interest rates, and offer more effective debt management plans to consolidate and repay debts.

- Negotiating with creditors – If you have existing debts, you can consider negotiating with creditors to improve your repayment terms by considering aspects such as interest rates, repayment periods, or even settlements.

- Building credit – By improving your credit, you will, over time, become eligible for more favorable loan options with better terms than personal loans for bad credit.

Frequently Asked Questions

Can personal loans for bad credit be used to start or invest in a small business?

Yes, some borrowers use personal loans to launch or support small businesses. However, assessing the risks and considering alternative business financing options is important, especially if more significant amounts are needed.

What should I do if I suspect I've been offered a predatory loan with excessively high interest rates?

If you believe you've encountered a predatory lending situation, consult a financial advisor or legal expert to understand your rights and explore potential remedies. You can also report predatory lending practices to regulatory authorities.

Can I use a personal loan for bad credit to pay off my tax debt?

Yes, personal loans can be used to pay off tax debt. However, it's essential to compare the interest rate on a loan with the potential interest and penalties from unpaid taxes to determine if it's financially beneficial.

Is there a difference between personal loans for bad credit and payday loans?

Yes, there's a significant difference. Personal loans for bad credit typically have longer terms and lower interest rates than short-term payday and high-interest loans.

Company Name: Payday Ventures Ltd (trading as Credit Clock)

Email: business@paydayventures.com

Phone: +44 208 064 1293

Disclaimers & Disclosures

Editorial Independence & Liability Notice

The content provided herein is for informational purposes only and should not be construed as financial advice or an endorsement of any specific product or service. While every effort has been made to ensure accuracy, completeness, and timeliness, no guarantee is made regarding the validity or reliability of the information presented. In the event of factual errors, outdated content, or inaccuracies, all parties involved in the publication and distribution of this content — including syndication partners — are held harmless. This article may contain errors or omissions and is subject to change without notice. It is the responsibility of the reader to verify all product terms with the relevant lender or service provider prior to taking any action.

Age & Status Requirements

Loan products discussed are available only to individuals aged 18 and over. All offers are subject to eligibility, verification of personal and financial status, and additional checks performed by the lender.

Not a Lender or Financial Institution

This website operates strictly as a loan connection service and is not a lender. Credit Clock does not make any credit decisions, does not issue loans or lines of credit, and does not determine loan terms. The service utilizes proprietary algorithms to match users with lenders based on their application details, preferences, and lender availability. The operator of the site does not charge consumers any fee for this matching service.

Compensation Disclosure

This website is funded through advertising partnerships. Lenders, lender networks, and third-party marketers may compensate the operator if a user is presented with or accepts an offer for a financial product or loan through this platform. This compensation allows the service to remain free for consumers. However, compensation may influence how and where products appear, but does not affect the objectivity of editorial content.

Loan Availability & Options

Credit Clock does not have access to all financial providers or loan products available in the market. Any loan offer received should not be considered exhaustive or definitive. Consumers are strongly advised to compare all available options independently and select products based on their unique financial circumstances and goals.

Representative APR & Loan Terms

Annual Percentage Rates (APRs) and loan terms vary depending on the lender, credit profile, and application details. This website displays a representative APR range of 5.99% to 35.99%, with a minimum loan repayment period of 61 days. Not all applicants will qualify for the lowest advertised rates. Loan products typically reflect closed-end credit agreements and may differ significantly across providers.

State Limitations

Loan services may not be available in all U.S. states due to regulatory restrictions and lender preferences. This platform does not operate in the following states: Arkansas, Connecticut, Indiana, Minnesota, Montana, New Hampshire, New York, South Dakota, Vermont, and West Virginia.

Credit Evaluation Practices

Submitting a request for loan referral constitutes authorization for participating lenders and service providers to evaluate the applicant’s creditworthiness. This may include soft or hard inquiries from major credit bureaus (Experian, Equifax, TransUnion) or through alternative data providers and consumer reporting agencies. Such evaluations may influence approval decisions and loan terms.

No Approval Guarantee

Filling out the application form does not guarantee loan approval. Loan amounts, terms, and timing of fund disbursement will vary by lender. While some applicants may be eligible for loan amounts up to $5,000, this figure is not assured for all users. The website does not guarantee funding outcomes or endorse any specific lender or offer.

Special Note on Tribal Lenders

Some lending partners may be sovereign tribal entities. These lenders operate under federal and tribal laws and may not be subject to state law. Interest rates and repayment terms from tribal lenders may be significantly higher than those from state-regulated institutions. Consumers should fully understand and review all terms before agreeing to any loan offer.

Final Cautionary Statement

Users are encouraged to exercise due diligence and consult independent financial professionals when evaluating loan options. All decisions made based on the information contained within this publication are solely the responsibility of the reader.

Company Name: Payday Ventures Ltd (trading as Credit Clock)

Email: business@paydayventures.com

Phone: +44 208 064 1293

Distribution channels: Banking, Finance & Investment Industry, Media, Advertising & PR ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release