DPM Mining Inc. Announces the Base Case after tax NPV results of a SMART triple ramp redesign of the Taylor project

SMART panel mining via trolley trucks increases the Taylor after tax NPV@8% from $1.27B to $1.76b vs the AZM 2018 PEA, shaft, blasthole, paste fill, base case.

TORONTO, ONTARIO, CANADA, November 15, 2021 /EINPresswire.com/ -- DPM #9 AZM Trade Off Study

DPM announces a SMART analysis of the South32 Taylor project using data from the AZM Technical Report AMC Update, Jan 16th, 2018, plus other reports posted on Sedar. South32 has had no input to the SMART economic analysis. This study was 100% funded by DPM Mining Inc to highlight the economic advantages the US patent based, SMART mining platform that reduces dilution to ~0%, increases productivity 200% to 300% while creating safe, shop like working conditions underground. SMART generates many other new ESG solutions, see DPM #10 EIN press release.

The AZM PEA indicated that at a COG of $75t, Taylor had 100m tons of sulphide mineralization between the 400ml and 1,000ml. AMC evaluated a range of mining methods and selected sublevel blasthole stoping (SLOS) with paste fill which typically has 10% to 15% dilution and recoveries 85% to 90% of the ore from steep dipping orebodies. To select stopes AMC reduced the kriged resource grade by 5%, and assumed 95% ore recovery of the designed stope tonnage. The PEA modelled 65% of the resource, resulting in a mill rate of 10,000tpd with a 20 year mine life. DPM redesigned the Taylor mine plan to optimize the mining productivity of SMART 15m wide panels using pit run oxidized waste rock as CRF aggregate. See DPM EIN press releases #1 to #8 for SMART technical details.

A SMART triple ramp system, using 10 battery assist 65t trolley trucks, was designed to access 20 levels above the 1000ml. Top cutting each 30m level includes confirmation drilling 5 lower lifts or ~4,000 SMART cells, while installing the the grid of SMART posts plus the continuous concrete floor-roof. Top cutting also creates a SMART spreadsheet of 400 to 1300 cells per 6m lift. SMART mining recovery is plus 90% as top cutting can extend SMART panels to the ore limits. Typical PEA blasthole stopes have a 2 cell x 4 cell footprint thus the 65% ore recovery is a reasonable estimate for mining a flat dipping orebody using 18m to 30m high stopes. See Image 21, green and red cells are $50 and $75 COG respectively.

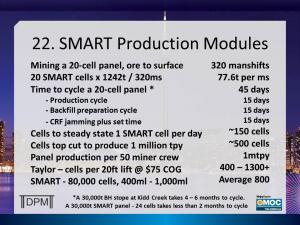

The SMART trolley ramp system was designed with 20 interchanges. SMART would top cut the 5 highest grade levels using up to 4 secondary production ramps to optimize SMART panel productivity. Mining 1 SMART cell per day requires cycling 5 SMART panels (~150 cells) to attain 100% utilization of mine equipment and labor. At $75 NSR COG, Taylor hosts 16,000 top cut cells and 64,000 standard SMART cells. Car parkade type internal ramps allows several 6m lifts to be mined in parallel. Mining 8 SMART cells or 10,000tpd requires top cutting about 1,200 SMART cells. Doubling Taylor mine-mill production rate to 16 SMART cells per day requires hiring 3 additional SMART mining crews plus 10, 65t trucks. See Image 22 for a table summarizing SMART Production Planning Modules.

Mining companies select the combination of the lowest cost mine design and mining method that exceeds the corporate IRR rate plus maximizes the NPV of the orebody. AMC estimated that the Taylor Preproduction Capex including the mill at $500m plus $500m of Sustaining Capital. The PEA production cost of $48.08t was modelled based on a stoping cost of $33.35t, milling at $10.73t plus $2.00t G&A. HG ore from the 3140 – 3260 levels was mined early generating a 42% IRR and an after tax NPV@8% of US$1.27b dollars. See page 214 of the 2017 PEA Technical Report, Hermosa Project posted on Sedar.

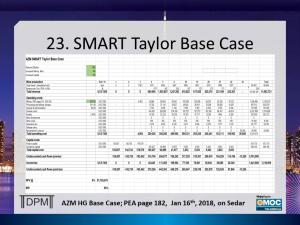

The PEA spreadsheet was rebuilt to calculate the NPV of the SMART financial benefits of top down mining of 15m wide panels. Assuming the same PEA ramp advance rate of 140m per month, the SMART triple ramp would access the Taylor sulphide ore which starts 400m below surface in 18 months. High grade, +20% Zn equivalent ore near the 600ml would be accessed in 30 months, matching the PEA preproduction schedule. See Image 23 for the SMART rebuilt BASE Case spreadsheet, entering 0% dilution matches the PEA NPV of $1.27b.

The Capex of the SMART ramp system including 10 trolley trucks is estimated at $203 vs $198.3 for the shaft complex which becomes redundant. SMART budgeted 4 secondary production ramps to match the blasthole HG mining schedule for the 5 highest grade levels. SMART's Capex would duplicate the PEA, $.5b Preproduction and $.5b Sustaining Capital. SMART direct mining and CRF costs from 50ft wide panels to surface is estimated at $25.25t. Reviewing other PEA line items indicates that SMART indirect costs would be less than $10.00t. Assume both mining methods cost a total of $48.08t, when $33.35t mining, $10.73t milling and $2.00t G&A are included. For the purposes of the trade-off study all SMART tele remote equipment was manned.

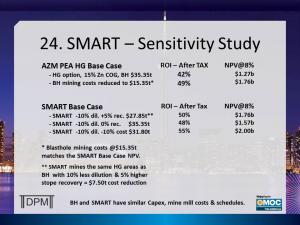

Two undisputable advantages of the SMART technology is that ore dilution at ~0% is a minimum of 10% less than blasthole. Secondly, SMART recoveries 100% of stoped ore not 95% which at a NSR value of $150t, translates to $7.50t of lost revenue. This in effect reduces SMART mining costs from $35.35 to $27.85t as per the NPV spreadsheet. The SMART Base Case increased royalties and smelter charges 10% to reflect higher grade mill feed.. See Image 24 for a SMART sensitivity table.

Three takeaways of the SMART Base Case assuming a financial gain due a 5% higher recovery of broken ore and 10% less dilution are:

1. The SMART Base Case generates a 50% IRR and an after tax NPV@8% of US$1.76 billion.

2. To match the SMART NPV of $1.76b, blasthole mining costs would have to total $15t, a $20t reduction.

3. Taylor production is scalable to 16 SMART cells or 20,000tpd for less then $1b Capex, thus doubling the Taylor after tax NPV@8% to ~$3.52b.

A minimum of 15 DPM EIN press releases will be issued to explain SMART mining to the ESG, financial and mining communities.

Charles Gryba

DPM Mining Inc.

+1 416-801-6366

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.